unrealized capital gains tax canada

As we head toward another federal budget to be released on March 22 there is much speculation about a change in the capital. Loans Lines of Credit.

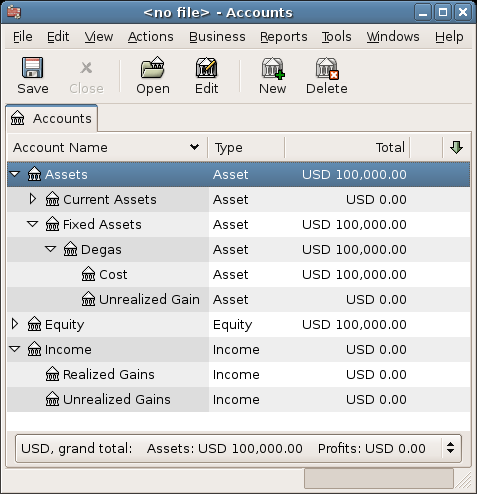

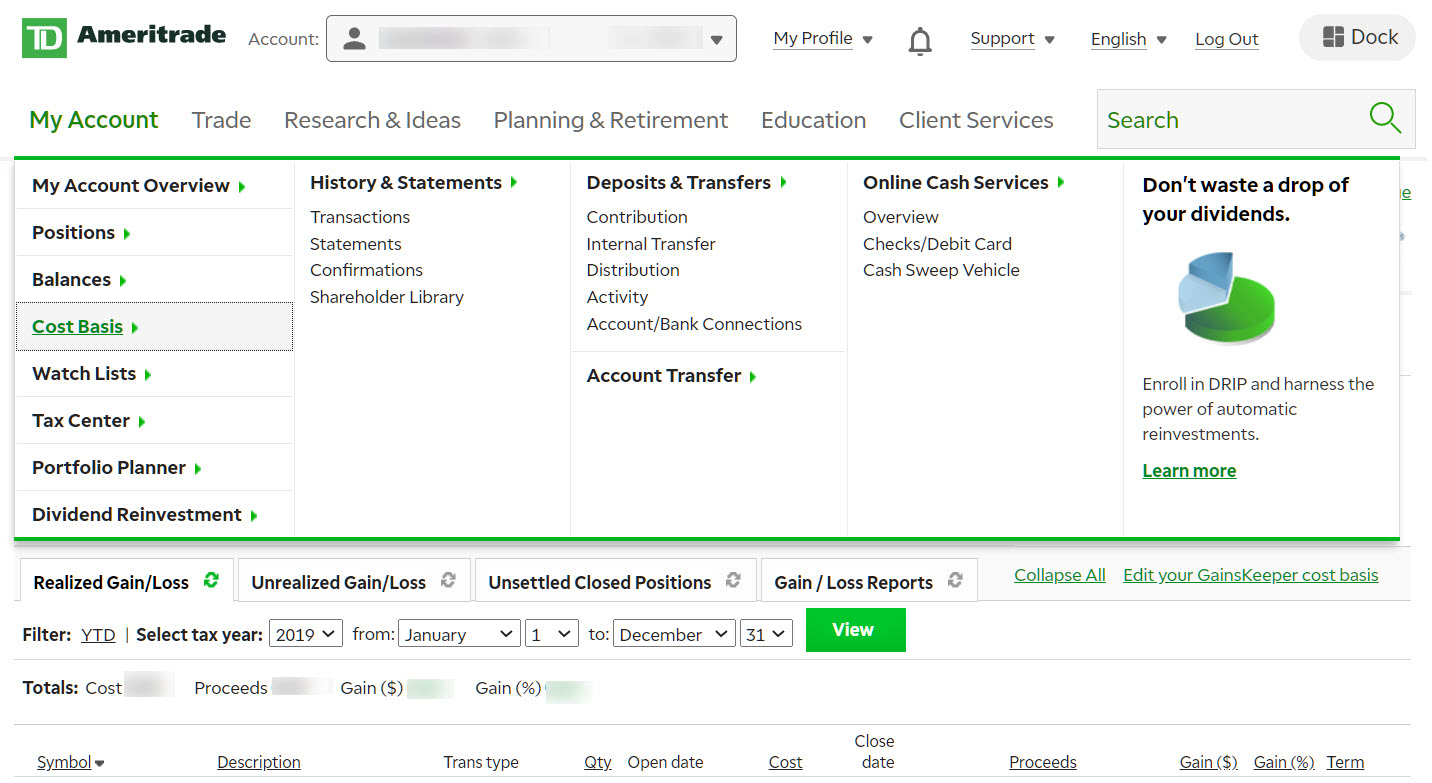

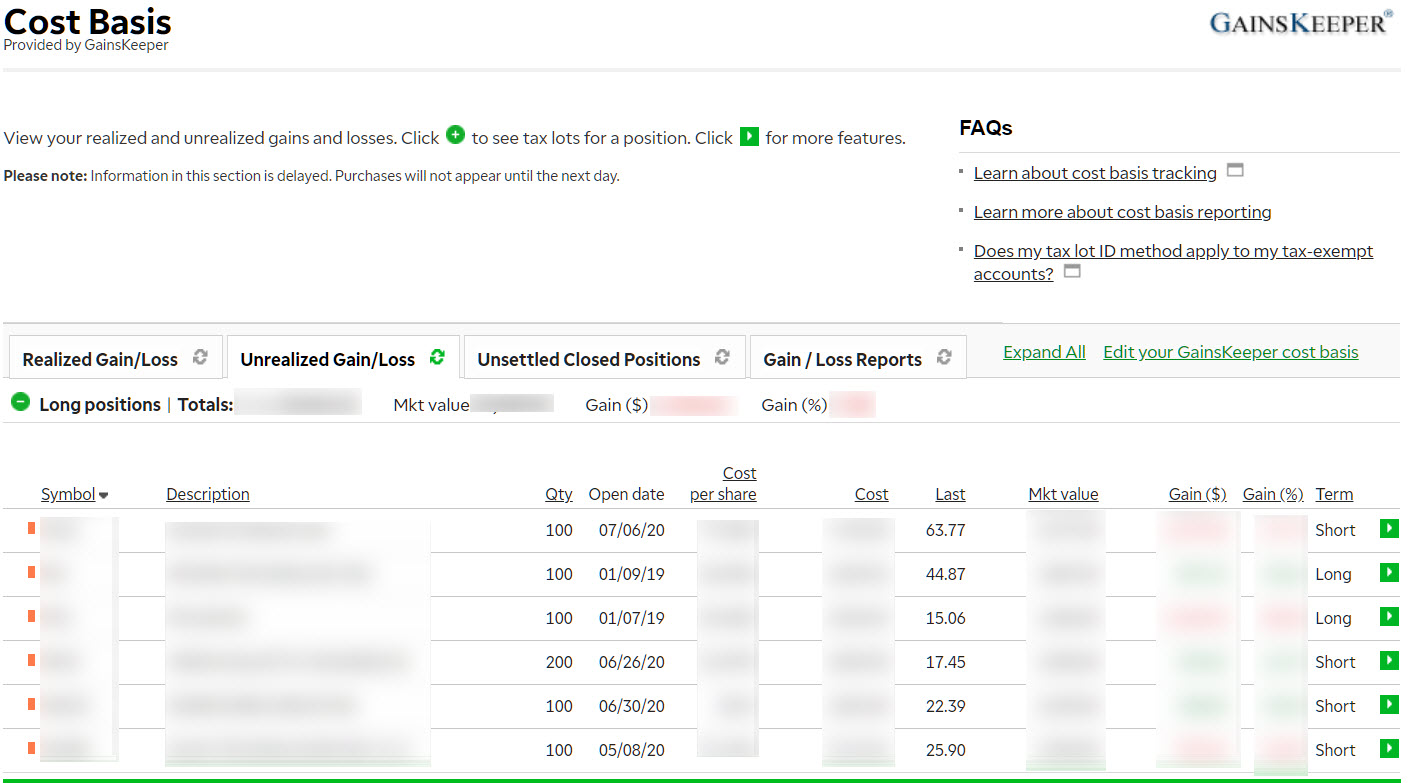

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Do you pay tax on unrealized gains Canada.

. In this commentary we discuss the findings from our new research on the estimated impact of the 1994 reform that dramatically increased the tax rate on capital gains. Do you pay tax on unrealized gains Canada. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. Since he purchased the BTC back in 2020 for 20K CAD he has now realized a gain of 40000 CAD. An unrealized capital gain occurs when your investments increase in value but you havent sold them.

Regardless of whether or not the sale of a capital property results in a capital gain or loss you have to file an income tax and benefit return to report the transaction even if you do not have. This gain is something that Bob would have to report on his income tax. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset.

The final dollar amount youll pay will depend on how much. The good news is you only pay tax on. How To Avoid Capital Gains Tax on Stocks in Canada.

The Problems With an Unrealized Capital Gains Tax. For example if you buy a. In Canada only 50 of the capital gain you realize on stocks is taxed the other 50 is yours to keep tax-free.

Do you pay tax on unrealized gains Canada. An unrealized capital gain occurs when your investments increase in value but you havent sold them. A well-balanced investment portfolio and a good trading strategy are likely to be the best option for you to reap the benefits.

An unrealized capital gain occurs when your investments increase in value but you havent sold them. Donate your shares to charity. 6 Ways to Avoid Capital Gains Tax in Canada.

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. If you hold an asset for less than one year and sell for a capital gain the. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

The amount youll pay in capital gains taxes depends primarily on how long you held an asset. The good news is you only pay tax on. Lifetime capital gain exemption.

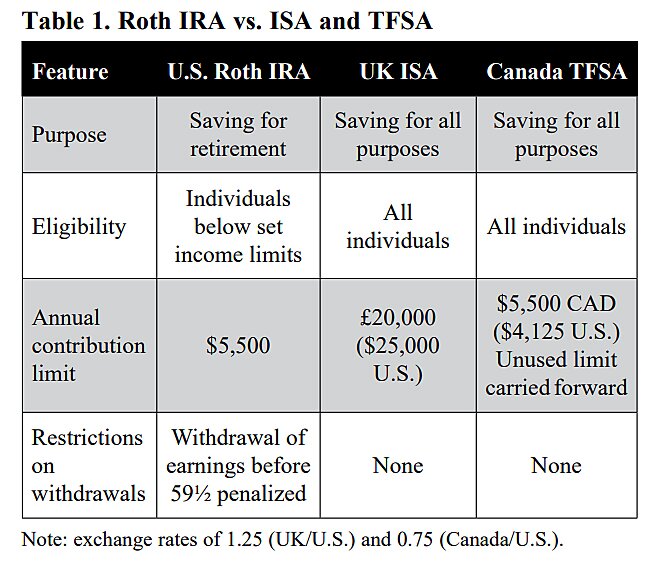

Canada assesses an exit tax on any unrealized capital gains inside taxable accounts in cases where the US. The good news is you only pay tax on. Unrealized Capital Gains.

Citizen moves back to the United States after having been a. Here is everything you need to know about capital gains tax in Canada so you can stay financially efficient.

Deferring Capital Gains Potential Benefits Russell Investments

The Oft Maligned Tax Increase On The Verge Of Becoming Law Politico

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Top Democrat Proposes Annual Tax On Unrealized Capital Gains Wsj

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Capital Gain Definition Types Corporate Tax Rates Example

Canadian Change Of Use Rules For Cross Border Real Estate Cardinal Point Wealth Management

Senate Democrats Push For Capital Gains Tax At Death With 1 Million Exemption Wsj

How Return Of Capital Can Enhance After Tax Etf Distributions Nasdaq

Bitcoin On Twitter Fyi Many Countries Implement A Wealth Tax Or Something Like An Unrealized Capital Gains Tax Examples Argentina 5 25 Canada 0 4 France 1 5 Spain 3 75 Netherlands 1 2 Norway 0 85 Switzerland

How Taxes On Capital Gains Work In Canada Capital Gains Income 101 Tax Loss Harvesting Youtube

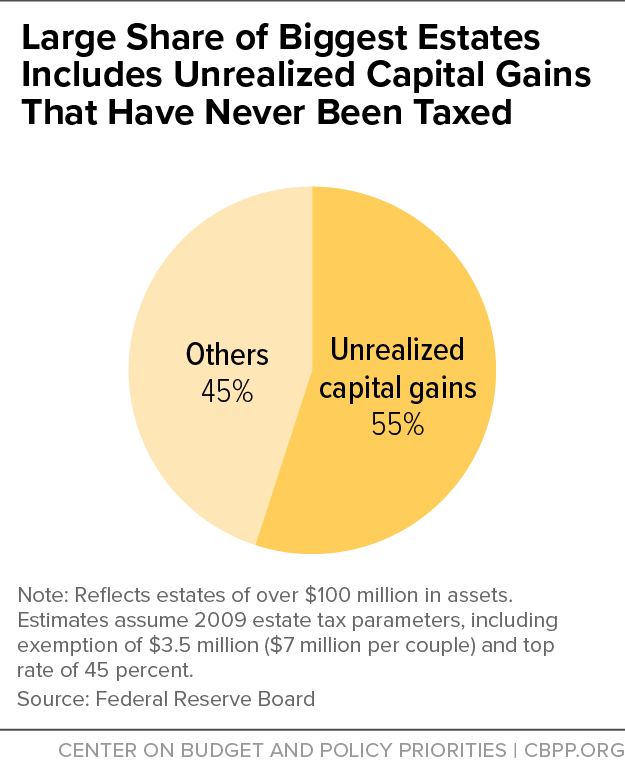

Large Share Of Biggest Estates Includes Unrealized Capital Gains That Have Never Been Taxed Center On Budget And Policy Priorities

Is There An Unrealized Gains Tax On Cryptocurrency Coinledger

Tax Efficient Investing Strategies Canada Financial Iq By Susie Q

Crypto Tax Loss Harvesting Investor S Guide Koinly

The 2 Tax Proposals Investors Need To Know About Right Now Barron S

Biden Expresses Support For Annual Tax On Billionaires Unrealized Gains Wsj

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada