kentucky income tax calculator

If you make 165000 a year living in the region of Kentucky USA you will be taxed 38724. Overview of Kentucky Taxes.

Kentucky Income Tax Calculator Smartasset

Both the sales and property taxes are.

. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. 1000000000000000000 - and above. The Kentucky tax calculator is updated for the 202223 tax year.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income.

Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator. A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the. Aging and Independent Living.

Enter your state individual income tax payment. Kentucky State Income Tax Calculator In the United States there are nine states that have a flat income tax. The tax rate is the same no matter what filing status you use.

Enter your details to estimate your salary after tax. 60000 income Single parent with one child - tax 3126. This income tax calculator can help estimate your average income tax rate and your salary after tax.

The Kentucky income tax rate is 5 for all personal income. This results in roughly 13643 of your earnings being taxed in total although. Kentucky Income Tax Calculator 2021.

The range we have provided in the Kentucky income tax calculator is from 1200 per month or 14400 per year to 12000 per month or 144000 per year. The tax rate is five 5 percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141019. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

For most counties and cities in the Bluegrass State this is a percentage of taxpayers. The state income tax system in Kentucky only has a single tax bracket. Your household income location filing status and number of personal exemptions.

The Kentucky income tax calculator is designed to provide a salary example with salary deductions made in Kentucky. Filing 6000000 of earnings will result in 459000 being taxed for FICA purposes. The wage base is 11100 for 2022 and rates range from 05 to 95.

Kentucky State Tax and Salary Calculators. The bracket threshold varies for single or joint filers. Select an Income Estimate.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Use our income tax calculator to find out what your take home pay will be in Kentucky for the tax year. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and special taxation districts.

If youre a new employer youll pay a flat rate of 27. - Kentucky State Tax. The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Kentucky State Income Tax Rates and Thresholds in 2022.

The penalty is computed separately for each installment due date where there was an. Unless youre in construction then your rate is 10. Kentucky Salary Paycheck Calculator.

Kentucky Income Tax Calculator 2021. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. Complete the respective Forms below sign and mail them to the Kentucky Department of Revenue.

How many income tax brackets are there in Kentucky. Switch to Kentucky hourly calculator. Your AMT tax is calculated as 26 of AMTI up to 199900 99950 for married couples filing separately plus 28 of all AMTI over 199900 99950 for married couples filing separately.

Kentucky State Personal Income Tax Rates and Thresholds in 2022. Kentucky imposes a flat income tax of 5. Underpayment of Estimated Income Tax or Limited Liability Entity Tax LLET for tax years beginning on or after January 1 2019- The amount of the underpayment or late payment of Kentucky estimated income tax or LLET multiplied by the tax due interest rate.

Kentucky State Income Tax Forms for Tax Year 2021 Jan. Our income tax calculator calculates your federal state and local taxes based on several key inputs. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753.

The gross monthly income of 125667 or 1508004 per year in the table represents the minimum wage in Kentucky in 2020 of 725 per hour. 35000 income Single parent with one child - tax 1676. Education and Workforce Development.

Kentucky is one of these states. The Kentucky tax tables here contain the various elements that are used in the Kentucky Tax Calculators. Remember paying your SUI in full and on time qualifies you to get a whopping 90 off of your FUTA tax bill so make sure you pay attention to the due dates.

25000 income Single with no children - tax 1136. The Kentucky income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. You can use our free Kentucky income tax calculator to get a good estimate of what your tax liability will be come April.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Kentuckys individual income tax law is based on the Internal Revenue Code in effect as of December 31 2018. 50000 income Married with one child - tax 2526.

If the AMT tax calculation results in an amount that is greater than your normal income tax you owe the difference as AMT. Annual 2019 Tax Burden 75000yr income Income Tax. The KY Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in KYS.

Select Region United States. Filing 6000000 of earnings will result in 286550 of your earnings being taxed as state tax calculation based on 2021 Kentucky State Tax Tables. 80000 income Married with two children - tax 3251.

Details of the personal income tax rates used in the 2022 Kentucky State Calculator are published below the. Select an Income Estimate OR. Support Education Excellence in Kentucky SEEK 310154.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually. Compare Credit Cards.

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings

Where S My Kentucky State Tax Refund Taxact Blog

Kentucky Income Tax Brackets 2020

![]()

Free Kentucky Payroll Calculator 2022 Ky Tax Rates Onpay

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Sales Tax Guide And Calculator 2022 Taxjar

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings

Kentucky Retirement Tax Friendliness Smartasset

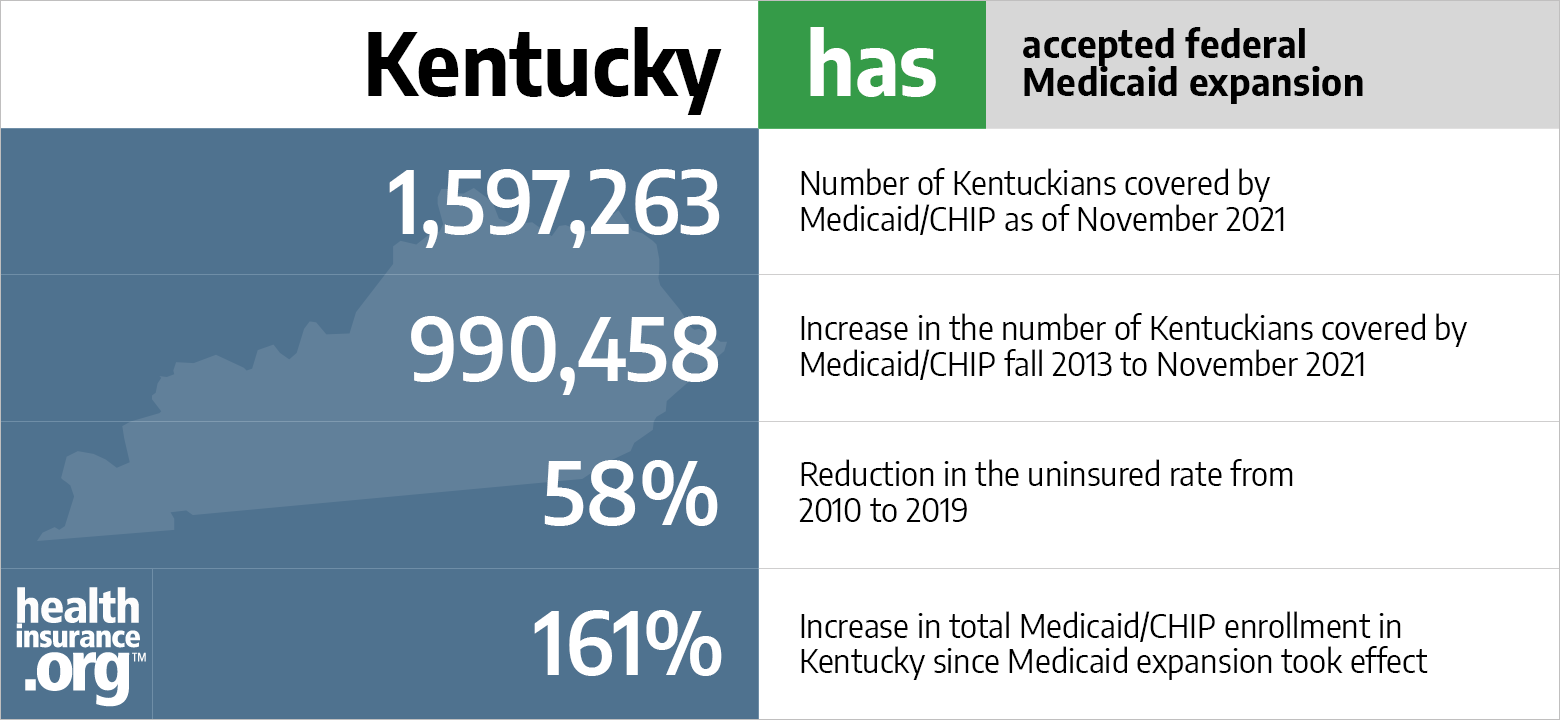

Aca Medicaid Expansion In Kentucky Updated 2022 Guide Healthinsurance Org

Kentucky Paycheck Calculator Smartasset

Employer Withholding Reciprocity Department Of Taxation

![]()

Individual Income Tax Department Of Revenue

Kentucky Income Tax Calculator Smartasset

Kentucky Income Tax Calculator Smartasset

Kentucky Sales Tax Small Business Guide Truic

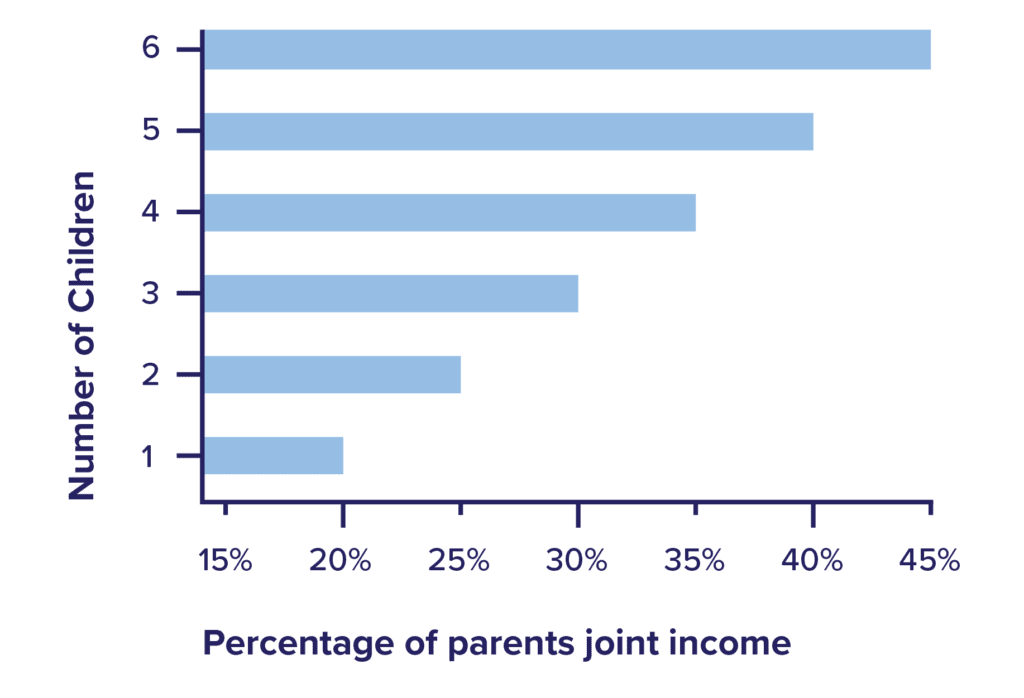

How Is Child Support Calculated In Kentucky

How To File The Inventory Tax Credit Department Of Revenue

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price